The world of online lending gets more and more crowded every day as new entrants to the market increasingly raise the bar of what is expected from an online lending site. The latest review from InvestorBlogger is for a company called NetLoans whose tag line is “Homeowner loans lowest ever rates on our any purpose secured loans!” NetLoans provides access to a variety of secured loans for home purchases, debt consolidation loans, bridging finance, and so on.

First Impressions: Polished, Bold and Web 2.0!

So, despite the slightly garbled tag line, the first impressions of the site are very pleasing indeed. The design of the website is clearly laid out: tabs along the top; interactive loan calculator right on the page, right hand sidebar, latest news headlines, and easy to find contact information.

It’s obvious from the first few clicks that a lot of thought has gone into the design and usability of the site from the users’ point of view so that users can find usable information from the moment they log on to the site. Unlike many similar sites, this quality would tend to make the site much ‘stickier’ than other sites in the same category.

The bold graphics, interactive forms, and fresh news feeds help to create the feel that this is a website designed for Web 2.0 though there are some obvious limitations in how far the model has been pushed. I did find it possible to get quite informative responses to some standard questions that I had.

The plus points on the site design are so many it’s difficult to know where to start: but I’ll highlight five that stand out to me as an outsider.

Loan Calculators: Interactive and Practical

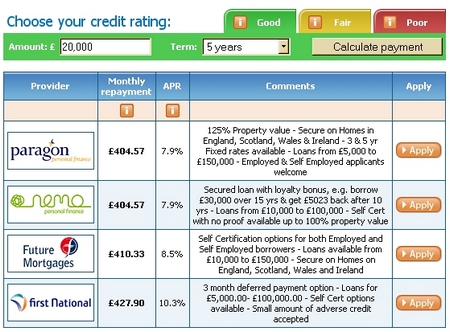

It’s difficult to imagine why many loan websites do NOT include these calculators at least some where on the website. What is more surprising is the bold decision to put the loan calculator right on the front page. As if that weren’t bold enough, there are two tweaks that make it even better: there are three grades –good, fair, and poor– of credit scores that (while not particularly precise) can help potential customers evaluate the kinds of payments they might be making.

Surprisingly, instead of just being requested to fill in details about your loan request, you can actually get some rule of thumb ideas about costs, options, and loan profiles BEFORE you commit to applying. In addition, you can (usually) get a choice of lenders as well by choosing different variables, credit rating, amount of loan, and loan period. The results automatically appear listed below. In fact, there are additional calculators in one of the other pages that can be used to calculate a debt consolidation loan. This interactive calculator is perhaps that appeals to me the most, because it can really help shape my thinking about the kind of loan that I would need, how much I can afford to borrow, and what terms are available. This alone is perhaps the best feature of the site.

Meeting Prospective Customers’ Leads: FAQs, Contacts, News, and an Affiliate Program.

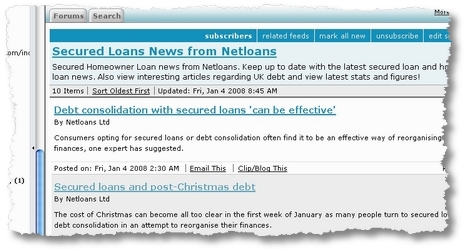

Many such websites provide the barest minimum of help hoping that visitors to the website will simply pick up the phone and call the 0800 number or hit ‘apply’ or ’email me’, not realizing that many visitors are simply browsing for information at first to find out what loans and options there are, how much they cost, and which companies are better at serving their customers. NetLoans aims to reach such customers by providing regularly updated news feeds, helpful FAQs, useful calculators, recent news and a glossary of terms .

(This image of a sample feed shows some of the stories that have been recently published on the feed.)

Additionally, customer contact details are available all over the place, including contact phone numbers, email, a physical address with a map, about the only thing that is missing is a “Live Contact” box that allows potential customers to contact you from the website page (I’ve used it several times, and it’s very effective on some sites!).

Last, but not least for Webmasters, there is an affiliate program that is available. I’ve signed up for the program, and may end up using it on my own website here. The promised pay out is GBP250 per applicant (which is a lot of money with the current USD in the toilet situation!). This could be an attractive way for Financial Bloggers to adapt and extend the features of the website within their own e-finance website.

And the catch…

So, what is the catch? Well, and this is a highly personal opinion, that such very web 2.0 sites miss out on one very important aspect of the web in 2008 – that of creating community and interaction between real people.

While it is apparent that the website is intended to be a e-commerce website, the lack of a personal element – a voice, as it were – doesn’t help to brand the site as customer-friendly. It would be great if there could be a personal voice that highlighted how the loans REALLY benefit customers, especially if that were written in direct and honest manner. While the word ‘testimonials’ comes to mind, I’m thinking much more of examples and entries of how the loan officers made a difference in customers’ lives. This would be best served in a real blog style format where communication and community could be brought together. That combined with photographs, videos, and other tools of the modern ‘blog’ could really draw additional traffic to the website and generate the feel of a real blog.

Other Suggestions

I think it would be a good idea to include a TOS (Terms of Service) and a Spam Policy, both of which would help to increase customer confidence and assurance that the company is serious about its business. Also, it would be great if there was a functional search box, accessible from every page, so users could enter key words and find the information they are looking for, not just what the webmasters want them to know. These are minor suggestions, but would help cement what is otherwise an excellent website.

Disclaimer: While this review has been paid for by NetLoans, the viewpoints expressed here are entirely my own. If you would like a review of a website, please contact me for more information.