It’s all about the dollars, cents, pounds and pence, isn’t it? After all, that’s what you’re all fighting about, isn’t it? That’s why you aren’t really entering non-US markets, … you don’t think Asian markets have enough cash, do you? Well, here’s my cash. I put my money where my mouth is: but you guys didn’t want it. Pity, I’ll reward those companies who do want it.

Who wanted it? Well, here’s my list of top three online music providers who were delighted to take my money, and provide me with great music to listen to. So drum rolls, please!

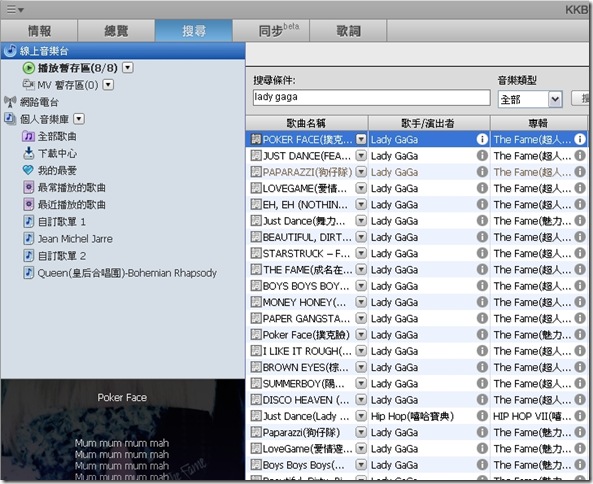

KKBox wanted my money, so I put down a subscription with them. And they made it so easy to pay: I could have paid in any of a dozen different ways, including just going to the local convenience store, and handing over my cash! This is a screenshot that includes some recently popular songs. The only caveat was that I had to set my default language on my PC to Chinese, which of course, broke one of my blogging applications. Never mind.

No problem. Last.FM made it really easy, too. So I plumped to spend money with them. Nothing needed to download, but it works. And there are software programs you can use if you need to.

I also put my money with Sky.FM who wanted it. Nothing to download here. Just play the stream in your favorite player.

It’s not that I didn’t want to give it to Emusic – they wanted too much with too many conditions attached, including paying for a catalogue that I couldn’t access – well done, Sony BMG!; iTunes wanted the money for the products (iPod, iPhone, iTouch, etc.) but didn’t want to provide the services to my country of residence; Pandora just shrank from the challenge of facing too many lawyers, without a good excuse.

After all, when did lawyers run a company? In fairness, lawyers are paid to respect the law, to follow the law and to help understand and interpret the law for other people. But, it seems that they are increasingly being used as an excuse by business leaders to hide behind.

Legal Music Alternatives

So I put my money where I could; and I’ll likely start buying even more CDs courtesy of Amazon, etc., … by the time that Emusic, iTunes, and Pandora wake up to the HUGE LEGAL opportunities they’ve missed, it will be too late for them to capture the market in many countries. Why? Because while they can wait, other hungry companies can’t, and neither can audiences. The world won’t wait for Pandora, Emusic or iTunes to grasp what’s being offered in terms of markets. Instead, these markets will take their ball, and play another game altogether.

Think that it hasn’t happened in Taiwan before? Think again.