How’s your stock investing doing? Have you been successful in the past ten years? Or has your 401K or personal investing account been sucked dry the gyrations of the stockmarket over the past few years?

Are you looking to get started with your first time investments? Or are you now dipping your toes back in the stock market because you want to rescue your current investment from its double digit losses?

Either way, you are going to need the right tools to help you do successful stock trading, aren’t you? And in these crazy times, this goes doubly so, after all…

Let’s face it: It’s been a Roller Coaster Ride

The past twelve years have made successful stock trading difficult for most people: a quick look at the chart of the Dow Jones from 1998~2010 reveals only part of the reason why.

Chart of the Dow Jones Industrial Average: 12 years

Summary 1998 ~ 2010

In January 2000, the market peaked and started sliding as the Dot Com Bubble came to an end in panicked selling as the air was sucked out of those stocks. But it wasn’t until the last quarter or 2001 when the Dow Jones hit its first of four troughs at around 8000 points.

In March 2003, we then saw a bull market that ran the stock market index from just south of 8000 to a peak of 14093 in October 2007, a rise of almost 75% or more. But of course, that represented a double top, indicating markets had nowhere to go but south.

Within 2 years, the market had headed south of 7000 as institutional sellers flooded the market with sell orders and found few buyers. Prices plummeted to a 12 year low before rebounding as the fear subsided, and confidence returned.

With 20-20 hindsight, those doing successful stock trading would have made a killing. Would have. Why didn’t we? In truth, volatile times make certain types of trading more profitable but wipes out portfolio values where more traditional buy and hold investing approaches hold sway.

For those investors tossed by the waves of uncertainty, buying high and selling low has only compounded the difficulties of their portfolio surviving the unsettling storms of the times.

A Personal Example

During this twelve year stretch, my own portfolio invested soared to $21,000 then dipped then soared then dipped to nearly 1/3 of that amount. Right now, it’s treading water at a little more than 54% of its high point, and I’m sure that total performance has been much worse.

Many investors also saw their portfolio value in the money and on sale during these ten years, and it didn’t help a lot seeing the hard-earned savings disappearing in a puff of virtual smoke. I know. I’ve been there.

What’s your excuse?

And, like me, you’ve probably been either too busy or too scared to know what to do during these volatile times in the past ten years. Too busy because your career or profession precluded you from taking the time to really study your investment strategy; too scared because, if you were at all like me, you found out that stocks can really go to $0. Thanks, AtHome.

I’ve been writing about stocks, personal finance, and investing for more than four years during this time, and I’ve tried to get a handle on the basics. That combined with extensive reading and owning my own business have helped me to focus on the real essentials of investing.

And yet

… even now, I’m convinced that if you (I?) can manage successful trading stocks, then you will find that they are a rewarding part of your investments for the long term, whatever trading style you choose to adopt.

However, for many people, investing is like a lottery: you buy a stock because you like the stock name, the product or the boss… but very often there is no real rational between the purchase of these stocks. In the end, it’s a lottery. But it needn’t be that way, if you know how to …

Choose your investing strategy

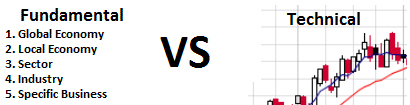

Broadly, stock trading strategies can be divided into those bought after a technical analysis of the stock and those purchased as the result of a fundamental analysis. So what’s the difference?

Fundamental analysis is usually based on analysis of historical and present data, with the aim of trying to determine both current and future value of the stock. Assessments of stocks using this means are a favorite of investors like Warren Buffett; and are often used to determine whether the actual or ‘intrinsic’ value of a company is currently undervalued or fairly-valued or over-valued.

As an example, looking at the chart above, you may determine that dow jones stocks were somewhat overvalued prior to 2008, but were on sale during much of 2008-9.

Technical analysis, on the other hand, looks at the future direction of stock prices through the study of past market data, especially pricing and volume. While there are many schools of thought, the general goal is to determine the direction and strength of a future stock price by looking for patterns in the stock price movements.

A quick look at the chart shows in 2007 a double top pattern, where the index twice reached a high of around 14000, and to technicians as a bearish signal in the market.

Whichever of these strategies you eventually decide to adopt,

The Stock Market Reaches Into Everyone’s Lives

such as how the stock market seems to impact everything in our daily lives; and how everything in our daily lives seems to have an impact on the stock market.

Think about it…

…every day you spend money. Everyone spends money differently than the next person. And everyone spends it on different things. The one thing that unites our spending is…

…you guessed it, the stock market. So, next time you pull into a gas station or are at the check out line at the grocery store, think to yourself how your purchase will affect the stock market and how the stock market affects the product or service that you will be purchasing.

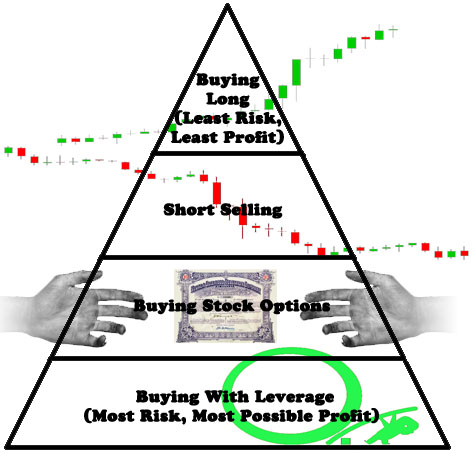

There is Risk

With each different type of trading, there is a different amount of risk. When you buy a stock long, you can only lose the money that you put in. There is a little bit more risk with selling short.

Buying Short and Selling Long

Even with that risk however, I have come to prefer (along with many others) short selling. There are two reasons why I prefer short selling. The first is that stocks can go down faster than they go up.

The second isn’t necessarily a preference to short selling. I just like to know that I have the option to make money when I think a stock is going to go down. And not just when its going to go up.

So, with buying short and selling long there is not much risk. However, with more advanced trading strategies you will encounter more risk. So, you should be comfortable with the basics before you dive in to these other methods of trading.

The other advanced forms of trading that you may want to check out when you master the basics include stock options and buying on margin.

Stocks, Options and Margin

Investing in stock options is a more advanced form of investing. Individual investors issue options and other individual investors purchase them. The issuer is betting that a stock will do something and the purchaser is betting that it will do the opposite. This is a very lucrative investment strategy but one that takes lots of practice to master.

Finally, buying on margin. This is as simple as it sounds. Buying on margin is when your borrow money from your stock broker in order to purchase more stocks. If you borrow money elsewhere, say a bank or a friend, it’s pretty much the same thing. And it is just as risky. Of course, like with any time you take out a loan, you will want to get the best rate possible.

A Solid Investment Vehicle

Win the lottery and people will most kindly inform of all the ways that you could invest your money. There are many different legitimate investments and not a few that are shady. But, I have come to find that stock trading is one of the most rewarding and educational ones you could pursue.