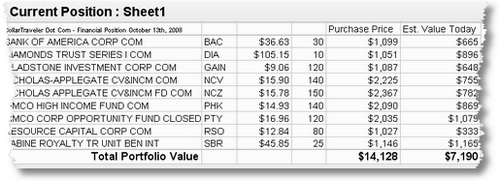

Well, the market is back up today (but with the poor performance of the economy, it’s going to be a couple of months before we know the after effects), and in the interests of ‘coming clean’, I’ve decided to reveal what my current stock holdings are. And when it was done, I was staggered how much the portfolio had gone down.

To view the entire sheet, just click on the image. What isn’t obvious from this chart, though, is the regular dividends that get paid into this account.

In 2007, they totalled $1031.53 and in 2008, they totalled $1078.24 with the prospect of another couple of months. In fact, the last couple of stock purchases had been made from the proceeds accumulating in the account. However, with the markets in turmoil, it’s likely that several or more of these dividends may be cut or axed altogether. Bank of America has already announced changes to its dividend as of this month. We also hold several thousand dollars in Mutual Funds via one of our insurance policies, but the details are quite old.

Since, 2001 I’ve focused more on investing for dividends as I believed that dividends do pay back some cash to the investor. Since purchasing my first dividend stocks, I’ve actually earned quite a lot over the years and managed to claw my stocks back to more than just par with 2001. But the last few weeks have eaten away approximately 45~50% of my portfolio’s nominal value. I had been underwater for a while (not including dividends).

The next few months are going to highlight how successful this process of choosing dividends has been, what volatility these dividends have, and whether dividends can actually bring some relief to the current mania. This is the next part of my gradual revelation of my personal assets, and once each part is out there, I will bring it together on a regular basis!