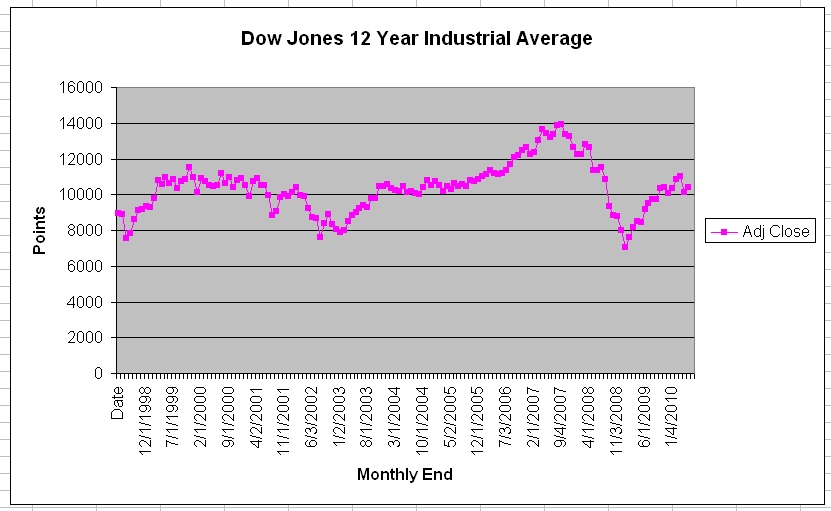

1998 was my first time to buy real stocks, and how exciting it was! I’d tune into CNBC Power Lunch night after night, read up on the latest theories, visit MotleyFool, and read quite a few tomes, cover to cover.

Now, I thought, who’d want to do any ‘paper trading’ when you can buy the real things? Mmm, well … the whole point of this series of posts is to look at my trades and see if they made any sense at all, then or now.

As it turns out, 1998 wasn’t a bad year for me in stocks at all. Given the go-go years of the Internet, you shouldn’t read too much into that previous statement at all! Throwing darts at a dart board would have produced gains in those years.

So what did I buy? How did they do? What did I learn? What can I share with you, dear reader?

Stick with me, as I introduce you to my Lucky 8 of 1998. They are Dow Stocks (or were at the time): GM, JPM, MMM, MO, CAT, and IP. And I added positions in DELL, and ATHM.

GM – General Motors, Inc. (now trades as 1998 ‘MOTQQ’, I believe)

I purchased 18 shares of General Motors, Inc. at $56.56 per share on September 10th and sold out at $61.88. There were additional dividends during my initial ownership, but my broker of those years (DATEK) has no records of which dividends they were. So the stock showed an impressive 9.39% gain not including dividends. In those days, I barely paid any attention to dividends. That has proved to be quite a mistake.

If I had held on to those shares, at today’s price, they’d be worth around $7.56 in total. Glad I parted with them, and a salutary reminder that owning shares in any company is a risk. In 1998, who’d have thought that GM would go bankrupt within 10 years. I promise you: no one would have expected that. I did repurchase GM in 1999 as well. Can’t remember why. But I didn’t hold it for too long. Look for that in 1999’s report.

Also there was a share divestment of Delphi Stock that came into my account in 1999. Didn’t hold on to them, since they weren’t part of the original plan. So I sold them, too. I sold 12 DPH $16.6875. This added to the overal profit, giving a total overall return in excess of 29%.

(It’s hard to get historical records for this stock, MOTQQ, as the stock symbol has been removed from most current databases.)

JPM – JP Morgan Chase & Co.

So on that fateful day of September 10th, I also bought 11 shares of JPM at $86.00 exactly. Not too shabby I thought. I then went on to sell them at $119.0625 in October 1999. Quite a pleasing return of 38.44% in 10 months, not including dividends (of which there were about $32.17*adj). Later in 1999, I repurchased 7 shares at a higher price.

Even now JPM still pays out a regular dividend of about 2.8%pa based on today’s price. Google estimates that if I had held onto the stock, it would have accumulated $388.63 in dividends, and have increased in total about 34.5% over those years. In fact, without dividends, I’d have been sitting on a loss, because of what happened after 2008!

MMM – 3M Company

In that first batch, I also purchased MMM at $70.1875 with a purchase order of 14 shares. I then sold these in 1999 at $94.25 producing a return of 34.3% return before costs without dividends. I had vaguely heard of 3M in those days, but have become quite a fan of this company since then. We use & prefer many of their products for both domestic & work.

This stock split once in a 2:1 deal, and currently trades north of $142. In other words, my original shares would now be worth $3975.00, and that’s not including dividends! Google estimates that an additional $680.33 would have been earned bringing that total portfolio to $4,671. Generating a total return of 475%.

MO – Philip Morris

Then I bought 23 shares of Philip Morris @ 42.6875 which I sold in April the following year for a loss at $34.1875. I was always troubled with this purchase ethically. My father smoked, my mother smoked. Many people of their generation smoked… but I didn’t. It troubled me that Philip Morris actually made money by creating addiction, then feeding it. Of course, selling it at a loss didn’t make things feel better. But at least, it was gone. I have NEVER reconsidered this point of view. I know some companies do WORSE things, but for me … well, cigarette manufacture stuck in my craw. I earned some dividends as well, $30.36.

However, if I had held onto this stock, I’d have earned quite a return: $1,964.43 in dividends, though not much in capital appreciation. Of course, there have been several spin-offs of this company, including Kraft Foods which would have netted some shares, if I had held onto the stock. But there we are.

Finally

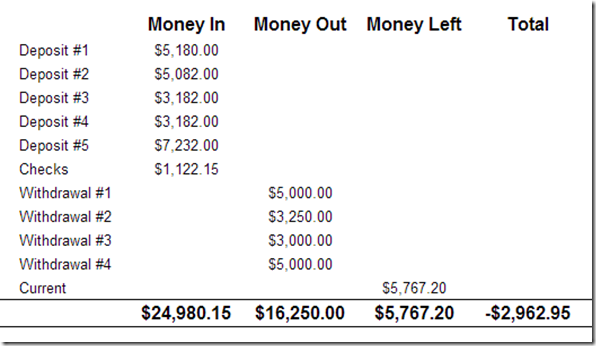

I will summarize the returns as best I can for you in the following table.

[table id=4 /]

In other words, if I had done nothing after those purchases, I’d have earned over 200% in those 15 years. That even includes the implosion of GM, and the outperformance by 3M. I’d still have dividends coming in from three of these companies, and there would have been additional upside from any divestments that Philip Morris made (namely, the tobacco company & Kraft).

Stay tuned for part 2. Coming this week: 5 Lessons from my first year in investing!