Following up on this week’s theme of Financial Issues, we’ve looked at Mortgages, Credit Cards, Loans, as well as making a little extra money , it seems fitting that we review Obares.com, a website that aims to provide “…the best way to sell your home or buy your dream home the FSBO ( For Sale By Owner ) way.”

In fact, the unique sales point of this website is quite simple: you will find the right tools including calculators (much simpler than opening Excel!), legal forms, mortgage information to help you buy and sell your home, and it includes (their words) a FREE FSBO Listing.

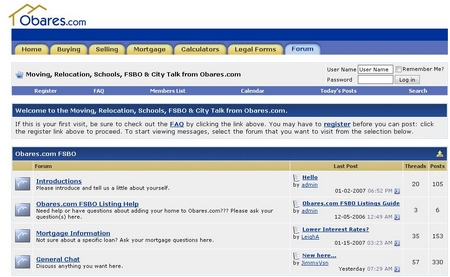

(updated information) When I went back today to visit the website today, I noted a new tab at the top for Forums and indeed there are: one for every state in the US. This is a very smart move on the part of Obares.com to include forums. VERY few Real Estate sites that I have reviewed in this blog have any kind of community feeling. In fact, it has been one of my leading criticisms of most of them. Creating a kind of community in your website allows you the opportunity to market your products to an obvious marketplace (don’t oversell!), increase traffic to your website overall, and build a relationship with clients that could last years.

It will take a while to bring traffic to the forums: I’d suggest the website owner create the states as child-boards, rather than simply mark 50-odd boards. It’s quite daunting for newbies to look through all of the boards. You could use a conventional approach: North, South, etc. Break the boards into about 8-10 major forums. Then add the states as children of the major forums. VB is quite capable of this. If you are interested in running good forums, TheAdminZone is well worth visiting both for information and as an example of how to run forums well.

Now, underpinning many of the financial issues that individuals and families face is the Credit Rating, which is an assessment of a person’s creditworthiness or ability to pay back any loan that is made. These days, Credit Reports are provided by agencies to lenders who then assess the applicant by referring to their FICO score.

For example, you have decided to buy a new house in Houston at $350,000. You walked into your local bank, picked up an application form for a mortgage, and filled it out. Once the application is complete, the bank will then refer to the credit bureaus for your score. It’s that score that can help you get the mortgage loan or have you turned down!

There is a lot you can do to reduce the risk of having lending applications rejected. The first is quite simple: know your own credit history and FICO score. You can apply to a company like Equifax to get your Equifax Credit Report, or Experian or Transunion so you can know what problems lie within your credit history. In fact, clicking through to the website will allow you to see some information on:

-

contacting the bureaus

- how FICO scores are calculated

- some tips on managing your credit cards

- and guidelines on what FICO scores mean.

There are significant benefits for knowing your FICO score. You’ll be able to tidy it up, correct any errors, check for fraudulent activity and improve your score, by knowing what to look for. Once that is done, you’ll find that you should get better offers on your loans, credit cards and mortgages, thereby SAVING yourself money! What could be better than that?

(Ed. I’ve extended the content since version 1.0 and tightened some wording and a picture).